Home KHA Solutions Group Affinity Partner Program

Affinity Partner Program

The Affinity Partner Program develops mutually beneficial relationships between hospitals and the private sector – relationships that are relevant, cost-effective and supportive of hospitals’ priorities.

The Affinity Partner Program is your source for a wide range of quality products and services designed to help your organization operate more cost-effectively. As a wholly owned subsidiary of the Kentucky Hospital Association, we listen to you and select products and services that meet your organization’s changing needs.

KHA established this program as a benefit to its members. The Affinity Partner Program provides member discounts and special offers that would not be generally available outside of this program.

Each Affinity Partner is closely monitored for quality performance and member satisfaction.

To become an Affinity Partner there is a stringent vetting process that includes a KHA Solutions Group (KHASG) Board Review based on the following criteria:

First, the service or product must meet the following guidelines:

- Live up to the claims it makes

- Demonstrate financial benefits to members

- Enrich the patient care our members provide or improve their business processes

- Provide a simple-to-implement process

Next, each vendor must offer exemplary customer service and support for our members, and be ready to resolve any issues members have promptly. They must have and maintain a solid standing in the health care field.

Finally, the service or product must be based on sound and proven health care industry evidence.

After successfully completing the process and once approved by the KHASG Board, vendors are awarded the “Affinity Partner” designation.

Our Partners

AblePay is a patient financial engagement tool that addresses the patient affordability gap for our KHA members and their patients and increases the patient experience.

Eric Capuano

(215) 806-1987

eric.capuano@ablepayhealth.com

- One-pager

- Overview video

- Webinar:

- Case studies:

- Ephraim McDowell Health

- St. Luke’s University Health Network

- Lehigh Valley Health Network

- Executive Summary

AblePay Health is a patient financial engagement tool that increases patient revenue, collection efficiency, and the overall patient experience. Through AblePay, KHA members receive the following:

- Prompt payment in 14 days, with absolutely no recourse.

- Patients/families save up to 13% or extend over time with savings or 0% interest.

- No patient denied along with no credit checks or propensity to pay scores.

- Easy implementation and integration; lower costs and better staff utilization.

- No changes to current internal processes and keep current vendors.

- AblePay Health assumes all the financial risk for their members.

- Build continued loyalty and brand identity with employers in the communities you serve!

Amanda Kinman, MBA

Chief Financial Officer, Ephraim McDowell Health

Our experience with AblePay over the past couple of years has been very positive. We chose to engage AblePay to administer our discount policy and to offer additional payment options to our patients. We have AblePay setup in our system to function similar to a secondary/tertiary payor, which promotes a seamless process for our patients. Our patients benefit from the flexibility AblePay offers, including various payment plan options, and there’s no credit check for patients to enroll in the AblePay program.

Our team has not experienced additional work related to the enrollment process. AblePay offers an online process, or patients can call a phone number and a live person answers the phone to walk them through the process and answer any questions. We do offer information about AblePay to our patients during registration, and we have visual aids and pamphlets located throughout our registration areas, including our hospitals, primary care, and specialty clinic settings.

In addition, we’ve been able to minimize adjustments, credits, and re-bills on the backend as a result of our AblePay implementation. Previously, when patients paid upfront, the out of pocket was estimated at the time of service. As a result, there were adjustments needed on the back-end because the estimates may not align with the final out of pocket costs. After implementing AblePay, patients are paying based on the actual out of pocket instead of paying based on an estimate.

Overall, we have been pleased with our experience with AblePay and the positive impact on our patient experience.

AffirmedRx is on a mission to improve health care outcomes by bringing clarity, integrity and trust to pharmacy benefit management (PBM).

Kristin Stadler

kristin@affirmedrx.com

AffirmedRx is on a mission to improve health care outcomes by bringing clarity, integrity and trust to pharmacy benefit management (PBM).

Their approach allows them to put members and their clients first, which directly supports the goals of their clients and the consultants and brokers searching for the best solution. Their differentiators below outline how they believe they are fundamentally different:

- AffirmedRx, a Public Benefit Corporation or PBC: created to benefit the public and serve its members. They are committed to a social mission and community considerations.

- By Employers, For Employers – What employers want and need does not exist in the PBM industry today and AffirmedRx was created to serve clients and their employees/members.

- Personalized care and compassionate navigation: Health care is local and personal and AffirmedRx understands the complexities of the

pharmaceutical industry. Members receive individual support for all their needs to mitigate script abandonment and decrease medical/emergency care costs due to non-compliance/non-adherence. AffirmedRx will bring this care model to your community and work from within that community.

- The model that matters: Patients over Profits – AffirmedRx is a company that delivers true cost control measures and reimbursement not predicated on shell games or bait and switch tactics – no hidden charges or financial withholds. They do not retain rebates, they do not retain spread, and complexities of they do not retain or bill any extra fees. They are a PBM you can trust. Care remains at the forefront of everything complexities of they do and in addition to translating to greater health and well-being, this approach mitigates medical costs resulting from denied medications in the traditional PBM model.

- Alignment: AffirmedRx is aligned with its clients and is deeply committed to delivering on its mission to operate in the best interest of its members/patients and customers. Their charter as a PBC provides AffirmedRx with the legal framework to do what is right by those who rely on them for care, rather than obligate ourselves to focus on profit for shareholders, which often occurs to the detriment of clients and the members they serve. Their executive leaders have personal accountability to do what is right as demonstrated through their compensation structure being contingent upon decision-making that benefits members and clients — as overseen by the board of directors.

- Intuitive, hyperflexible technology and an intelligent, care-driven platform: AffirmedRx is delivering the best of the best in its platforms – doing things differently and cultivating partnerships with technological disruptors that simplify the administrative infrastructure and work processes so 90% of the effort can be flexible, nimble, and focused on members and clients — where it really matters.

Bill Dunbar & Associates provides outpatient Clinical Documentation Improvement (CDI) solutions that focuses on medical documentation, coding accuracy, compliance, and reimbursement for both fee-for-service and risk-adjusted models.

Terri Scales, CPC, CCS-P

800-783-8014

ts@billdunbar.com

Bill Dunbar and Associates (BDA) provides comprehensive and effective solutions in the health care industry. BDA focuses on three main areas – Medical Documentation and Coding Compliance, Health Informatics and Reporting, and Organizational Leadership Training and Development (both virtual and on-site).

- BDA Medical Documentation and Coding Compliance Solutions provide revenue growth strategies to clinics and hospitals throughout the United States.

- BDA Health Informatics Solutions provide actionable healthcare information and decision-making tools for populations, providers and patient-specific health, treatment and cost challenges.

- Dunbar Organizational Health provides virtual and on-site training and coaching to develop a stronger health care partnership culture to drive better results for patients, providers and organizations.

BDA’s team of professionals includes certified coders, health care informaticists, data architects, trainers and coaches with decades of experience working in the health care industry. All of BDA’s solutions offer comprehensive, customized, budget-neutral programs focused on improving organizational health through developing and implementing growth strategies designed to improve its clients’ bottom-line.

Navigating the Pressures of Emergency Department Revenue Capture

In the Emergency Department (ED), costs are rising, acuity is rising, but revenue is struggling to keep up with these increases. Reimbursement for patients discharged from the ED is driven by the facility’s level of service, for which there are no national guidelines, and supplemented by the capture of other procedures and services performed in the ED such as IV medications and laceration repairs. Documentation from the care providers and understanding of the “why” by all involved will result in the correct reimbursement for the services you have provided.

During the May 30 KHA Town Hall, Terri Scales, CPC, CCS-P and Cara Geary, CPC, COC, CEDC, CCS-P with Bill Dunbar and Associates (BDA) discussed the need for a team approach which includes the ED professional services providers (physician, NP, PA), nursing staff, coding, AR/ROI, and information technology. Having all stakeholders understand the “why” will ensure your facility captures the appropriate reimbursement for the services provided.

Something to think about:

Are all Emergency Department services provided documented appropriately? Are you accurately capturing all Emergency Department services supported by documentation, to ensure appropriate facility reimbursement?

For KHA members:

KHA’s vetted partner for outpatient clinical documentation improvement (CDI) and consulting services, Bill Dunbar & Associates (BDA), typically helps providers see net improvements at 20% for the ED facility (and 15% for the physician practices). BDA provides a solution to address the margin pressures that hospitals are experiencing. They also include a unique compensation model that shifts the risk to BDA – no need to budget for their services. BDA’s coding services are designed to improve outpatient medical documentation. Their focus is on compliance, documentation, coding, and reimbursement, and helping emergency departments and outpatient clinics reach optimal revenue capture. The training occurs at all levels of the revenue cycle (front office, back office, practitioner, etc.).

Shellie Shouse, CPA, MBA, FHFMA, FACHE, RHCEOC

Chief Executive Officer

Ohio County Healthcare

On behalf of Ohio County Healthcare (OCH), we extend our sincere gratitude to Bill Dunbar & Associates (BDA) for their exceptional support and partnership since 2021. BDA has consistently showcased their expertise in enhancing our documentation, coding, compliance, and provider knowledge towards billing.

Their initial preliminary analysis provided valuable insights and reinforced our confidence in BDA’s capabilities. The seamless data collection allowed us to focus on the results, which have been crucial for our recent expansions in areas like the emergency department, hospitalist program, physician practices, and risk-adjustment initiatives through BDA’s HCC ReClaim product.

With BDA’s coaching, we implemented a provider coding accuracy threshold of 85%, achieving impressive results. As we raised our goal to 90%, it was encouraging to see our providers actively engaging with their BDA representatives, highlighting the trust they have in this partnership.

Our VP of Provider Practices remarked, “BDA is by far one of my favorite vendors. They are responsive and knowledgeable, navigating the complexities of documentation and coding with ease. The dashboard they provide is masterful.”

Thank you, BDA, for your invaluable support. We look forward to continuing this fruitful partnership.

Mei Deng

Chief Financial Officer

T.J. Regional Health

T.J. Regional Health had the opportunity to engage BDA for their complimentary preliminary analysis of our surgical and anesthesia charts. The results not only confirmed our initial thoughts but also highlighted the exceptional expertise that BDA brings to the table. Thank you, BDA, for your excellent work with the complimentary analysis.

The Berkshire Group specializes in the identification, recovery and return of payments owed to its clients that were never known, received, or deposited by the client.

Robert Horowitz

Founder and President

62 Reinman Road

Warren NJ 07059

(908) 642-7479

Fax: 908-754-3115

rh@berkshiregroupconsulting.com

The Berkshire Group specializes in the identification, recovery and return of payments owed to its clients that were never known, received, or deposited by the client.

When these “one off,” non-regular and non-recurring payments go uncollected, the sender remits payment to the states. Here, at the state level, these uncashed payments remain until, when and if, the client commences a recovery action for their repatriation.

Berkshire will work with clients to find unpaid claims using their proprietary process.

Berkshire does the heavy lifting and requires very little of the clients’ time.

Berkshire handles all aspects of the claims-recovery process quickly, correctly, and professionally.

Organizations agree to pay Berkshire 20 percent of the recovered claim payments. Berkshire never touches the recovered funds. All recovered payments are mailed directly from the states to the client.

After the client receives payment, Berkshire is paid 20 percent of the recovery.

In 2023, Berkshire recovered over $20 million for their 25+ healthcare and other sector clients.

Berkshire maintains offices in Miami, Los Angeles, Boston, and New Jersey. They have multiple clients in many states and industries.

Notable healthcare clients include Vanderbilt Health, Georgetown University Medical Center, Sinai Healthcare of Baltimore, Atlantic Health Systems, one of New Jersey’s most prestigious healthcare systems; AllSpire Partners, a regional GPO with over 50 hospitals, several thousand medical offices and locations and an enterprise value more than $20 billion.

College and university clients include Vanderbilt University, Brown University, Rutgers University, University of Maryland, College Park, and University of Delaware.

Amy Arndell

Chief Financial Officer

Breckinridge Health, Inc.

The Berkshire Group quickly identified all lost refunds, rebates, and vendor payments claims for our organization. Berkshire handled all of the paperwork and we just waited to receive the check. Due to the successful outcome, and ease of the program, I highly recommend The Berkshire Group.

John C. Yanes, FACHE, CPPS

President, Saint Joseph London, Saint Joseph Berea, Saint Joseph Mount Sterling

The Berkshire Group came through for us. They successfully secured several thousand dollars for us through the lost refunds, rebates, vendor payments. The process was easy, efficient and effective. Given their success with three of our hospitals, we will engage the Berkshire Group for our other facilities.

I am the tax director for a large academic medical center in Nashville, which was previously operated as a division of a large university but is now its own separate legal entity. The large university engaged The Berkshire Group, and as part of its engagement, Berkshire found unclaimed property for the Medical Center, leading us to engage Berkshire.

As a rule, our tax team regularly searches state unclaimed property records for outstanding claims, but we found The Berkshire Group’s search to be more comprehensive and to include even time-consuming tasks, such as searching all DBAs. We simply provided our organizational chart and some background regarding our structure. Even with our internal unclaimed property reviews, Berkshire quickly identified $360K in additional claims. To claim the unclaimed property, I provided my ID and electronic signature (items typically required for any unclaimed property claims), and Berkshire handled the rest.

Berkshire identified additional unclaimed property and secured the claims quickly because of its experience and relationships with the states. Berkshire started our project immediately after engagement, and I’ve found them to be responsive; effective; and they have not expected payment of the contingency fee until we received the funds from the claim. Based on my positive experiences, I would recommend working with The Berkshire Group.

As the largest provider of Chronic Care Management in the U.S., ChartSpan can help you improve outcomes for Medicare patients with multiple chronic conditions while generating revenue* for your practice. We also offer other forms of preventative care, like Annual Wellness Visits and complimentary quality support.

Erik Anderson

(408) 603-7838

erik.anderson@ChartSpan.com

ChartSpan’s Chronic Care Management can lower 30-day hospital readmissions by 52% and patients’ annual costs by 21%, while increasing patient claims for preventive and primary care.

How? With CCM, patients receive 24/7 access to a nurse line for remote care, help with appointments and medication refills, and a dedicated clinician to support them in building a care plan and care goals. Care coordinators can direct patients back to their provider’s office for vaccinations, screenings, and other forms of preventative care, raising quality scores.

CCM can also bring practices new revenue streams, with the average practice earning more than $100K in annual revenue with just 300 enrolled patients*. RHCs and FQHCs can receive up to $125K for the same volume of patients.

Many clients also choose to use ChartSpan for their Annual Wellness Visit solution. Our AWV software, RapidAWV™, empowers patients to complete their Health Risk Assessment as part of an existing appointment, so they’re more likely to receive this valuable source of preventative care.

Want to learn more about CCM, quality support, or AWVs from ChartSpan? Contact Erik Anderson at erik.anderson@chartspan.com.

*Results may vary by provider.

Jennifer Eskridge, RN

Care Coordinator, Breckinridge Memorial Hospital

“The main challenge was time. I felt as the sole care coordinator for three clinics and eight providers, there was not enough time to devote to looking for potential patients while managing existing patients.

Katrinka Whitney, MSN, RN

Nursing Director of Quality & Community Engagement, Park DuValle Community Health Center

Partnering with ChartSpan has been a game-changer for us. Their chronic care management services have helped us streamline our operations, reduce administrative burdens, and improve patient outcomes. The ChartSpan team is responsive, reliable, and highly skilled. They have seamlessly integrated their technology into our existing systems, allowing us to provide personalized care plans and continuous support to our patients with chronic conditions. We are incredibly grateful for their partnership and the positive impact it has had on our healthcare delivery.

CorroHealth is the leading provider of clinically led healthcare analytics and technology-driven solutions, dedicated to positively impacting the financial performance for physicians, hospitals, and health plans. With over 17,000 employees worldwide, CorroHealth offers integrated solutions, proven expertise, intelligent technology, and scalability to address needs across the entire revenue cycle. Our global presence extends over 10 locations, including the United States, India, and the United Kingdom, enhancing our ability to deliver exceptional service on a large scale. More information can be found at corrohealth.com.

Laura Penton

Regional Director, Revenue Cycle Solutions

Laura.penton@corrohealth.com

(469) 768-0075

We encourage you to stay connected with us through our other communication channels, including:

Your Partner for Clinical Revenue Cycle Management

Seamless strategies to align patient care, operational efficiency, and financial health.

Patient Experience

- Registration & Scheduling

- Insurance Eligibility & Authorization

- Financial Counseling

Chargemaster Services

- Market-Based Pricing

- Chargemaster

- Price Transparency

- No Surprises Act

Utilization Management

- Admission Status Reviews

- Physician Advisors

- Peer-to-Peer Reviews

- Analytics as a Service

Clinical Documentation

- Inpatient CDI

- Outpatient CDI

- HCC Coding & HEDIS Abstraction

- Provider Education

Coding

- Coding Automation

- Outsourced Coding

- Coding Audits and Education

Claims Management

- Billing & Claim Edits

- AR Management & Follow-up

- Specialized AR

- Payment Posting Reconciliation

- Self-pay

Denials

- Denials Prevention

- Denials Management

- DRG Downgrades

- Transfer DRGs

Value-Based Care

- RAF Accuracy

- HCC Coding & HEDIS Abstraction

- Risk Adjustment Program

- VBC Strategy & Action Plan

Technology

FairCode combines the expertise of experienced physicians with modern data science and analytics technologies. FairCode’s physicians bridge the gap between your attending physicians and hospital coders. The result? Patient acuity and Case Mix Index is more accurately captured; your reimbursement adjusts accordingly.

Steve Hansen

(615) 600-2166

steve@docuvoice.com

- Real time reporting dashboards

- Increased documentation accuracy and specificity

- Seamless EHR connectivity

A Kentucky Hospital’s Experience with FairCode

HSG Advisors empowers its hospital and health system clients through market and provider-focused innovative analytics and strategic advisory, illuminating executive decision making, fostering growth, creating operational efficiency, and overall, driving financial sustainability.

DJ Sullivan

502-814-1198

DJSullivan@hsgadvisors.com

Based in Louisville, KY, HSG Advisors empowers its hospital and health system clients through market and provider-focused innovative analytics and strategic advisory, illuminating executive decision making, fostering growth, creating operational efficiency, and overall, driving financial sustainability. Leveraging data-driven strategies, proprietary analytics, and the advisory of seasoned experts, HSG also partners with KHA Solutions Group to provide hospital members with ambulatory, physician office and practice market share data on a quarterly basis.

This initiative provides each member hospital with a quarterly ambulatory and physician office market share report. Details within the report will include the overall share for each hospital’s defined service area and the market share for each hospital’s service area, by patient county. In addition, the reports will outline core service line share for six standardized service lines for all hospitals. These service lines include cardiology, orthopedics, oncology, neurosciences (including spine), physical therapy, and primary. Cross service line reports for outpatient surgical procedures and imaging will also be included in the quarterly report.

HSG’s data partnership with KHA allows for unique access to ambulatory and physician-level all-payer claims. The proprietary grouping and reporting of data include ambulatory and physician office services for all patients living within an identified market county. Patient service counts are based on the number of unique patients having a unique service at a particular facility.

Educational programming that addresses data interpretation, utilization, and strategy development resulting from data insights will be addressed by HSG throughout this new partnership with KHA.

Stacey Biggs

Stacey Biggs

Executive Vice President of Marketing, Planning, & Development, TJ Regional Health

HSG Advisors has revolutionized our approach to data-driven metrics and management dashboards, enabling us to prioritize our energy on strategic growth initiatives resulting in the highest ROI. Their expertise in leveraging data has empowered us to identify and address market and service line shifts with precision. By utilizing their innovative tools and insights, we have been able to optimize our growth strategy. This has not only improved patient retention within the system but has also allowed us to make data-driven decisions that have proven successful time and again. We are grateful for their expertise and highly recommend their services to any organization looking to harness the power of data to drive strategic growth.

Kerry Tague

System Director of Business Development, UK King’s Daughters

HSG Advisors has been a valuable partner in our journey towards growth and success. Their expertise in data analytics, and consulting has allowed us to gain deep insights into our health system and physician networks. With their help, we have been able to identify opportunities to reduce patient leakage. Their strategic focus on growth strategy has given us a clear roadmap to follow, and their analytics have provided us with the knowledge we need to make informed decisions. We highly recommend HSG Advisors to any hospital looking to achieve strategic growth and enhance their overall performance.

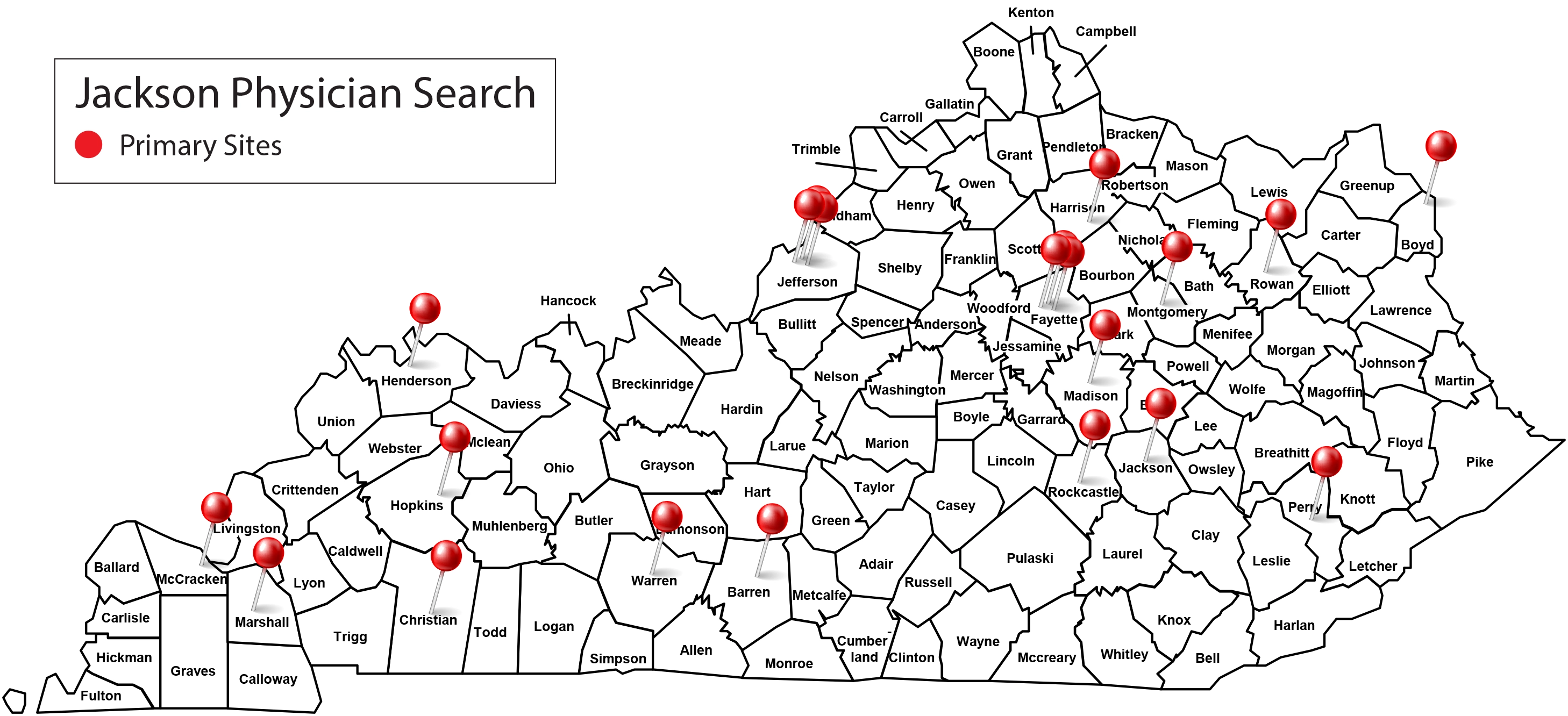

Jackson Physician Search is the largest, privately owned, and most trusted firm in physician recruitment. Specializing in the permanent recruitment of physicians, physician executives, and advanced practice providers for hospitals, health systems, and medical groups across the U.S. The firm’s mission, rooted in over four decades of service in healthcare, is to always deliver what it promises.

Tim Sheley

Executive VP, Business Development

770.490.3055 Cell

770.643.5544 Office

sheley@jacksonphysiciansearch.com

Nancy Brewer

Senior Director, Client Development

404.936.4396 Cell

770.643.5517 Office

nbrewer@jacksonphysiciansearch.com

- Research and Reports: Data-driven reports to understand the critical issues impacting physician recruitment and retention.

- Recruitment Resource Center: Best-practice insights, guides, and tools to power successful physician recruitment.

- Physician Recruitment ROI Calculator: Discover the true cost of a physician vacancy and the revenue impact of a faster time-to-fill.

Partner With a Physician Recruitment Firm Dedicated to Your Success

Local Focus, National Reach

Jackson Physician Search is the largest, privately owned, and most trusted firm in physician recruitment. Specializing in the permanent recruitment of physicians, physician executives, and advanced practice providers for hospitals, health systems, and medical groups across the U.S.

As a proud KYHA-Endorsed Business Partner, Jackson Physician Search is committed to supporting Kentucky hospitals in improving patient access to care by recruiting physicians who fit, succeed, and stay. The firm’s mission, rooted in over four decades of service in healthcare, is to always deliver what it promises.

100% Digital Candidate Sourcing Drives Faster Placements

- Every position is posted until placement on a network of 10+ national job boards, plus specialty-specific job boards.

- Optimized job emails are sent to the largest opted-in, most engaged physician database.

- Every recruiter has a license and is certified to recruit on Doximity – no other firm provides this level of access.

- Data-driven social media strategy maximizes visibility.

- 24/7 digital sourcing strategy, combined with a dedicated recruiter and transparent recruitment process and fee structure, allows for market-driven adjustments that maximize candidate acquisition – at no additional cost.

Choose a Recruitment Partner with a Track Record Built on Trust and Transparency

Since 1978, the Jackson Physician Search team has delivered for thousands of clients nationwide, filling their searches quickly and cost-effectively from our extensive network. Read their Physician Placement Success Stories.

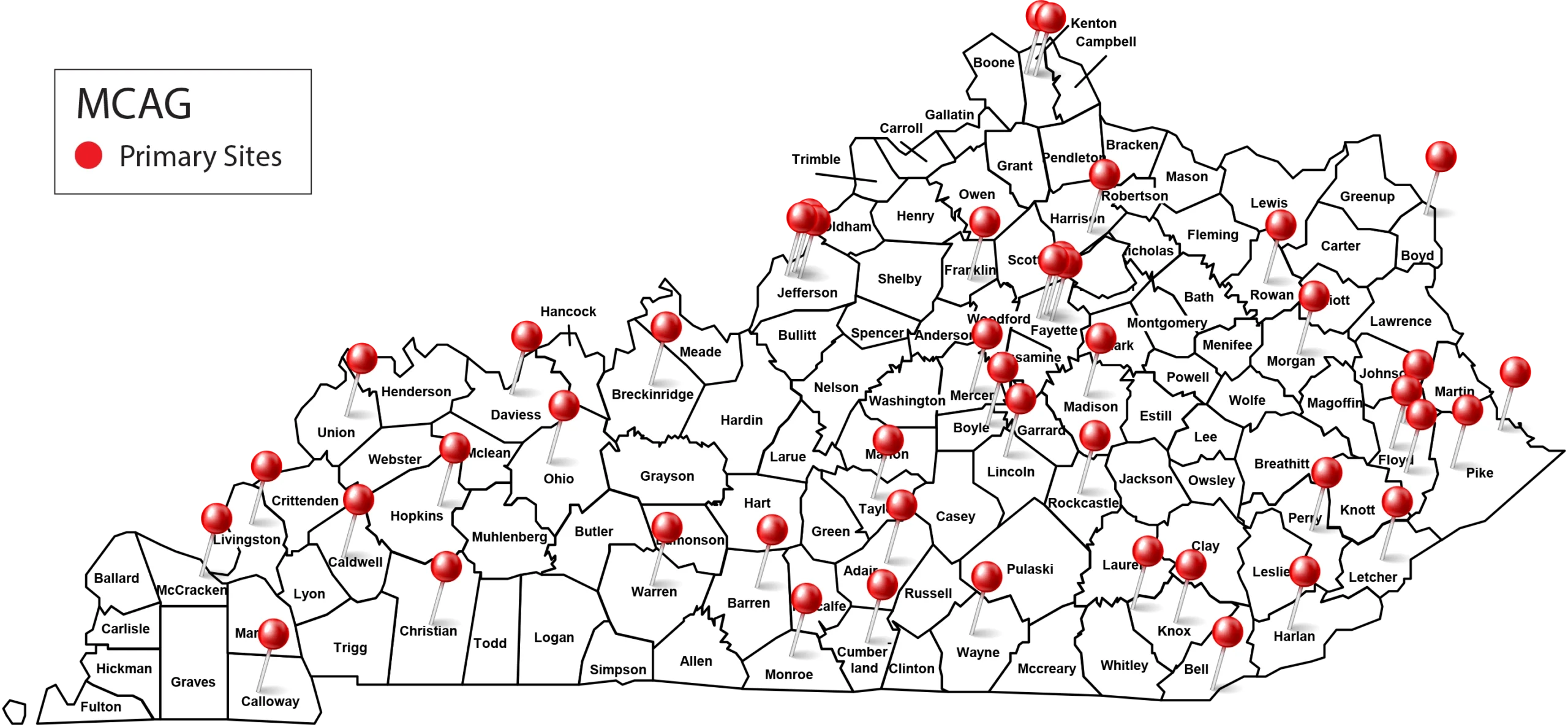

Settlement opportunities account for billions of dollars in available funds annually. Regrettably, businesses large and small are often denied the money they are entitled to because they don’t have experience negotiating with claims administrators or preparing the required documentation, data sets or forms.

Kimberly Johnson

800-355-0466 x2630

Cell: 818-640-3164

Kimberly.Johnson@mcaginc.com

- Settlement Profile: Blue Cross Blue Shield Provider Settlement

- Class Action Settlement Opportunities Quarterly Report: Q4 – 2024

- MCAG Class Action Settlement Recovery Service

- Settlement Profile: VISA/Mastercard Interchange Fee Class Action Settlement

Class Action Settlement Recovery Service

Settlement opportunities account for billions of dollars in available funds annually. Regrettably, businesses large and small are often denied the money they are entitled to because they don’t have experience negotiating with claims administrators or preparing the required documentation, data sets or forms.

MCAG is an expert at identifying and recovering non-traditional high margin revenue for all types of organizations from class action settlements. They have experience and credibility in getting the most for your claim with the least effort on your part. Clients have received hundreds of millions of dollars from settlement funds via their Settlement Recovery Service (SRS).

They don’t create class actions, they continually search for class actions that have already settled and have funds available for their clients. Monitoring settlement opportunities and effectively filing claims is a complex and resource-intensive process. Engage with MCAG experts so you can focus on core tasks that help you manage and grow your business, while they optimize your returns from class action settlements.

MCAG only works on a contingent fee basis when providing recovery services. You avoid upfront fees and enjoy the comfort of knowing that their motivation is in harmony with your needs and expectations.

MCAG provides services to over 290,000 businesses of all types and sizes, including aerospace, manufacturing, academia, health care, retail, hospitality, construction and more.

Quick Facts

- Cash recovered for clients: Over $300 million (One health care system in Florida recovered $237,000+)

- Number of contracted settlement recovery services clients: Over 3,000

- Number of merchant outlets registered for pending Visa/Mastercard settlement: over 290,000

Payment Card Settlement Disclaimer: Claim forms will begin to be delivered and available online in December. No-cost assistance is available from the Class Administrator and Class Counsel during the claims-filing period. No one is required to sign up with any third-party service in order to participate in any monetary relief. For additional information regarding the status of the litigation, interested persons may visit http://www.paymentcardsettlement.com, the Court-approved website for this case

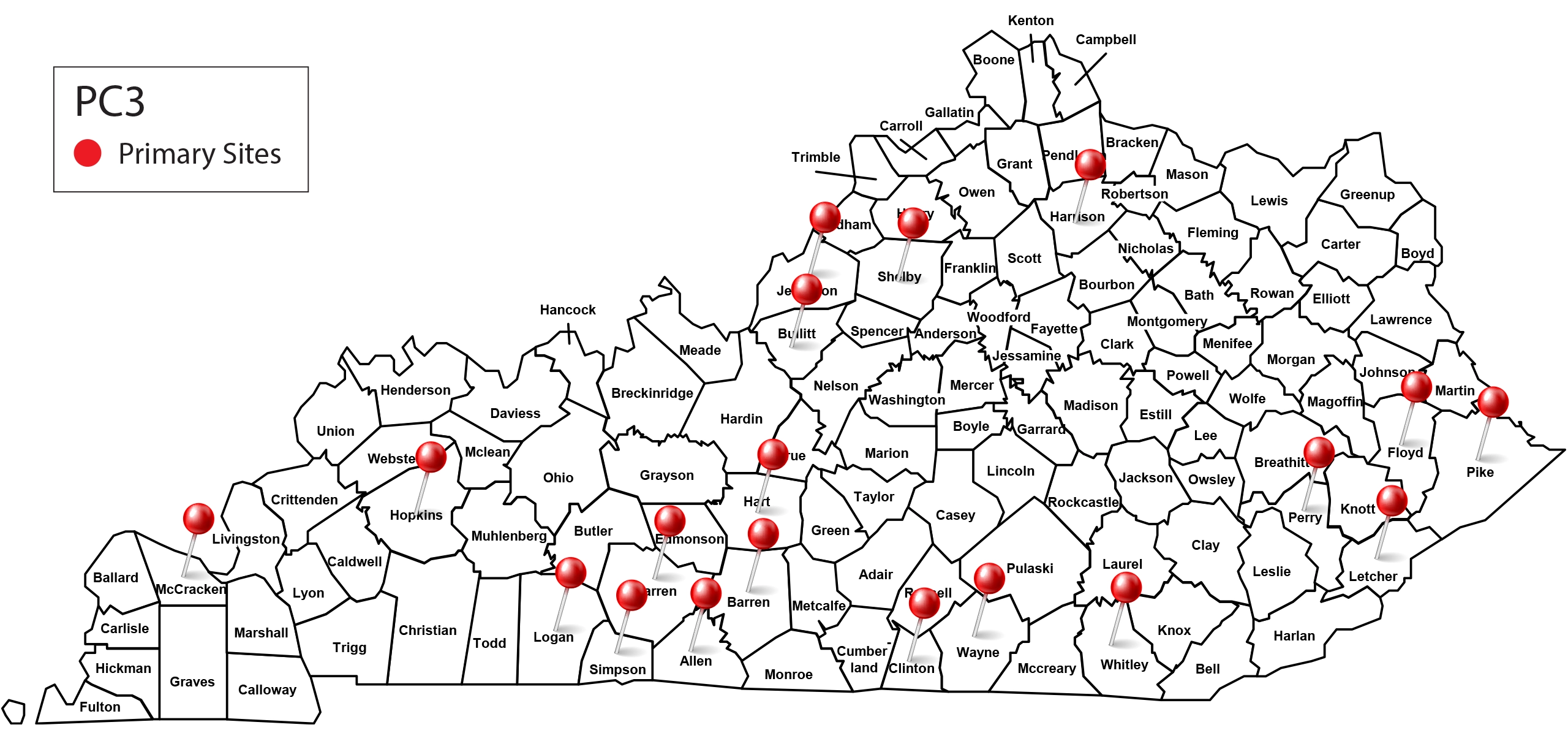

UM Physician Advising, Case Management Consulting, Denial Management, CDI, and Analytics and Project Management Services

Gayle Dickerson

gayle.dickerson@pc3health.com

Our mission is to drive financial wellness in healthcare organizations so more patients can receive the care they deserve.

We are the denials prevention champion. We fight for better outcomes and brighter futures for healthcare organizations and the patients and communities they serve.

Working side-by-side with healthcare organizations we take an innovative personal approach to overturning payor denials and preventing them in the future. And deliver ROI that outpaces our nearest competitor by nearly 40%.

We are physicians and nurses who have experienced what healthcare organizations experience. We know how to help them get more yes, to bring in money so patients can get the care they deserve today and in the future.

Our services include:

- Utilization Management Physician Advising

- Real time inpatient and outpatient case reviews and peer to peers, and post-acute (SNF, LTACH, IRF) case reviews

- Case Management Consulting

- Weekend case management coverage, high-risk denial UM reviews, UM/CM education

- Denial Management

- Inpatient and outpatient denials, post claims audits and recoupments, and appeal letters

- Clinical Documentation Integrity

- Assessments and staff competency evaluations and education, DRG downgrade and clinical validation denial management, physician advisor support, targeted case audits

- Analytics and Project Management

- Predictive analytics and monthly analytics dashboards

James M. Frazier, M.D.

Chief Medical Officer, VP – Norton Healthcare

“When patients arrive at one of our practices or facilities, it is important that they get the care they need. This often means ensuring that patients are appropriately classified with payors and insurance denials are addressed quickly and accurately. We have chosen to partner with PC3 to facilitate these functions and they have done an amazing job for our patients.”

Chad E. Mathis, MD, MBA

Associate Chief Medical Officer- UofL Health

“Since partnering with PC3, we have seen significant improvements in Utilization Management and Claim Denials services. The team at PC3 are true experts in the healthcare industry and put their clients first. Their approach to utilization management and claim denials has allowed us to streamline the appeals process and increase our success rate. We could not have a better partner in our corner than PC3!”

Stephen K. Toadvine, MD, MPH, MMM

Chief Medical Officer – Harrison Memorial Hospital

“Our engagement with PC3 has produced a phenomenal ROI. We could not be more pleased. Dr. Shah and his team are always professional, responsive, and collaborative. Every interaction is value-added for HMH.”

Automated and Retroactive Philanthropic Matching

Steve Hansen

(615) 600-2166

steve@docuvoice.com

Automated and Retroactive Philanthropic Matching

Automatically find and match financial assistance to patient bills. Reduce administrative burdens, enhance patient care and recover more bad debt.

Qualify Health offers risk-free adoption with no-code integration and no fees with our unique pay-for-performance model. We get paid when you do.

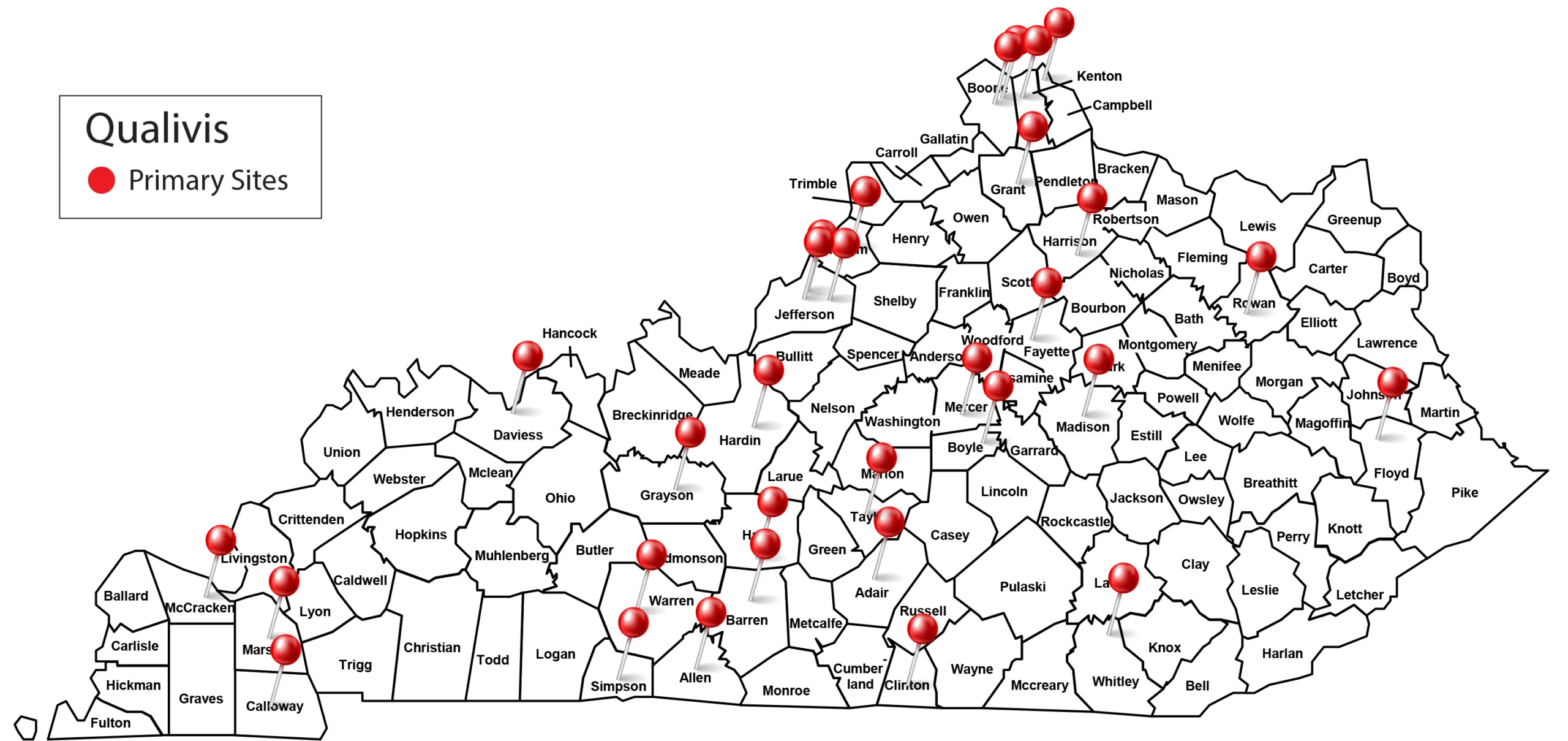

When you’re searching for a cost-effective contingent workforce solution, there’s only one place you need to turn: Qualivis, a trusted provider of healthcare workforce solutions that simplifies staffing and helps hospitals and health systems build a better workplace to improve patient care.

Joseph A. Dunmire

803-999-1310

jdunmire@qualivis.com

Endorsed by associations, trusted by hospitals

Qualivis is the only vendor-accountable MSP designed by hospitals for hospitals, offering tailored workforce solutions through partnerships with over 240 vetted agencies. Unlike others, Qualivis provides 24/7 visibility, data-driven decision-making, and committed partnerships with 27 state hospital associations, building stronger, sustainable healthcare workforces through consultative, long-term relationships.

Since 2002, Qualivis has worked with state hospital associations, health care facilities and a national network of staffing agencies to keep clinical and non-clinical departments staffed through a simple, standardized approach. All Qualivis services and solutions create efficiencies, increase savings, mitigate risk and improve quality.

By working with Qualivis, you’ll have access to the full suite of whole-house staffing solutions including:

- Travel nurse and allied

- Locum Tenens

- Non-clinical

- Interim leadership

- International

- Workforce disruption

- Workforce consulting

LotusOne technology

- Vendor management

- Permanent hiring

- Float pool management

- Workforce planning

- Predictive scheduling & Staffing

When you partner with the Kentucky Hospital Association and Qualivis, you will benefit from increased visibility, easy-to-use technology, efficiencies and savings for the full lifecycle of staffing procurement. Qualivis is your one-stop workforce solution – fully customized to meet your needs.

Kathi Eldridge, CPC, SSYB, AVP, Talent Acquisition, Baptist Health and Darren Heitzman, Manager, Vendor Relationships, Baptist Health

Bridget Goins, MPA, PHR, SHRM-CP

Director, Human Resources at Baptist Health

Working with Qualivis has been great. When I first heard about all the benefits, I thought it was too good to be true. If I would’ve known earlier what I know now, I would’ve switched to Qualivis a long time ago. We love the nurses that we have on assignment. And knowing that we have the ability to hire them once their assignment is over – at NO COST or fee – is just one more way Qualivis supports my hospital.

Cindy Gueltzow

System Vice President – Supply Chain Services at Baptist Health

When one of my facilities under contract with Qualivis experiences a workforce challenge, Qualivis has been quick to help us resolve the need. They are very responsive and take action immediately upon understanding our needs. I can trust that their workforce managed solution will help us get the highest qualified candidate at a competitive bill rate, at the right time. Feel free to contact me if I can provide feedback on Qualivis.

Radon Medical Imaging, offering its services since 1976, is the distributor in Kentucky for United Imaging, a Houston-based company that is revolutionizing the MRI, PET CT, CT, and DR space.

Eric Bowen B.S. RT R

Senior Vice President – Sales

(866) 723-6698

ebowen@radonmed.com

Radon Medical Imaging, offering its services since 1976, is the distributor in Kentucky for United Imaging, a Houston-based company that is revolutionizing the MRI, PET CT, CT, and DR space.

Do you have medical imaging equipment needs?

United Imaging equipment offers low cost of ownership and has an extended life cycle that includes software upgrades for life to ensure you receive new applications as they are released, reducing unforeseen upgrade costs.

United Imaging’s equipment has one easy, uniform software platform and the same user interfaces across all Untied Imaging modalities making it easier to learn and train in addition to being less complex for servicing.

The United performance guarantee is beyond the typical – they pay you back for downtime, regardless of your coverage period.

As a West Virginia company, Radon’s location enables them to offer a fast response time and coverage with 42 engineers.

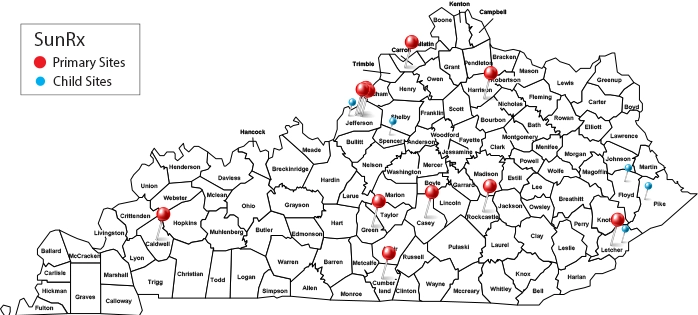

Compliance is the core of the SunRx 340B solution. SunRx assists their clients to maintain accurate and current 340B database information, recertify eligibility annually, help prevent diversion to ineligible patients, block Medicaid claims to avoid duplicate discounts and prepare for program audits.

Lori Schilling

Manager, Regional Sales

858-204-6710

lschilling@sunrx.com

SunRx offers the easiest and most effective way for rural health providers to take advantage of the 340B opportunity. SunRx helps hospitals and health centers:

Generate Revenue. Capture revenue from patients with third party coverage, and generate $40 or more from each qualifying claim.

Reduce costs. Reduce the cost of medications for eligible patients by half.

Launch contract pharmacy networks. Your hospital does not need a 340B inventory, additional staff, or an outpatient pharmacy. We can build a seamless network of retail pharmacies to dispense 340B discount drugs.

Improve patient care. Help patients save money on medications so they fill their prescriptions, go to the emergency room less often, and have better health outcomes.

Simplify 340B. At no upfront cost, SunRx can administer all aspects of your 340B program, including eligibility, inventory, third party payments, and regulatory compliance.

Health centers and hospitals in Kentucky and across the nation are choosing SunRx to implement and manage 340B programs.

Rick Neikirk

Chief Executive Officer – Cumberland County Hospital

SunRx has been a great partner for Cumberland County Hospital. This partnership has allowed us to stretch our resources while also being a valuable asset to some of our most vulnerable and cash paying (non-insured) patients. We have seen financial benefits from our 340B program while also helping to improve patients’ health and wellness with lower prices on prescriptions. SunRx helps CCH stay HRSA compliant and the staff has been helpful anytime a need arises.

Questions?

Pam Kirchem, MBA, FACHE, CHFP, CSPPM

Associate Vice President, Affinity Partner Program

(502) 220-8430